Allan Breese has worked in the information business for nearly thirty years, and joined TNS (then known as AGB) in 1975.

Allan was Retail Director of TNS's Superpanel service for many years. In this role he was responsible for supplying the information needs of many leading grocery retailers in the UK.

At Europanel (which is jointly owned by TNS and GfK)Allan has been responsible for the development of new information services to meet the ever-changing needs of international grocery retailers.

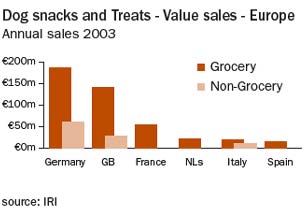

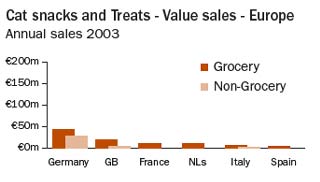

Showing modest overall growth of some 4% by value, the market for Cat and Dog Snacks achieved sales of €620m in 2003. This represented close to 10% of all consumer expenditure on Cat and Dog food in the Western European countries covered, with the dog snacks sector being more than five times larger than that for cat snacks, although growing at a slightly slower rate.

Germany is by far the largest market at some €320m, accounting for almost half of dog snacks sales and approaching three quarters of cat snacks, a high proportion of which are sold through the extensive network of non-grocery retailers in Germany. Lower than in Germany but still larger than the other 4 countries combined, value sales in Great Britain of €185m are even more strongly weighted in favour of dog snacks, which have grown in Grocery outlets by 11% since 2002.

The comparison of dog snacks value sales through grocery outlets across the countries reveals that they command a significant share of all dog food in Germany (33%), Netherlands (25%) and in Great Britain (18%) but elsewhere just 8% or less. The equivalent comparison for cat snacks sales shows much smaller shares, with the highest occurring in Germany at 5%. But cat snacks are more popular through the non-grocery channel where they hold a 7% share in Great Britain and the highest of all, 13%, in German non-grocers.

An unlikely feature of both dog and cat snacks, shown most dramatically in Great Britain, to a lesser extent in Germany and indicated to a degree in other countries, is a seasonal lift in sales at Christmas. In Great Britain, in the final four weeks of the year, in the Grocery outlets, we typically see sales of cat snacks rise to a level 150% higher than the average experienced during the rest of the year and 40% higher for dog snacks. The same effect is seen through the independent pet shops in Great Britain where sales of cat snacks are up by 90% and dog snacks by 30% during this peak sales period. Clearly, the British are buying these as presents for their pets at Christmas, a behavioural trait that is much more rarely exhibited elsewhere in Europe

Cat and dog snacks branded sales through grocery outlets are dominated by Masterfoods and Nestle Purina. Masterfoods is the leading manufacturer in most cases with notable exceptions being for dog snacks in Italy and cat snacks in France, where Nestle Purina is the leading manufacturer, and cat snacks in Spain where Affinity Petcare take the largest share.

Generally speaking, own label is not yet a major force in cat and dog snacks except for that from Aldi in Germany. With sales of €44m in 2003, Aldi in Germany accounted for 7% of the entire 6 country total value sales and 14% of all sales in Germany. Aldi sales of dog snacks were double those of cat snacks but as the total market for cat snacks is that much lower than for dog, Aldi accounted for one third of all German cat snack value sales through grocers in 2003. Clearly consumers have benefited from the lower price option of a product which is generally only available at a high price premium. Since Aldi entered the sector in 2002, sales of cat snacks in the German grocery market have increased by the same amount as Aldi now sell, which, along with a tripling of other own label sales has pushed the branded sector down to only just above 50% value share. Similarly, branded sales of dog snacks in German grocery stores have only 60% of the market in 2003.

As a rule, distribution levels for the leading brands across Europe are high in the grocery outlets, despite the relatively low sales in many countries. Highest in Germany, Great Britain, The Netherlands and dog snacks in France, the leading brands regularly achieve in excess of 90% weighted distribution. Less well distributed are the cat snacks in France and Italy with the leading brands of both cat and dog snacks in Spain achieving 60 to 70% distribution.

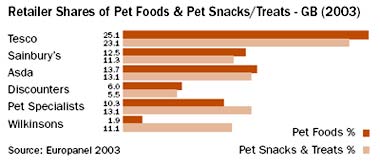

There is a marked difference in where consumers shop to purchase their pet snack & treats by country. In the UK, pet specialist retailers (especially pet superstores) enjoy a higher share of this category than for the mainstream pet foods categories. This is likely to be due to consumers perceiving that specialist retailers offer a better range and value of products than supermarkets. However, of particular interest here is the massive share for Wilkinsons – a discount variety retailer. Wilkinsons are renowned for their low prices across a wide range of hardware, household and seasonal products and their share in this category is clearly a function of consumers seeking value. At just over 11% this is nearly six times their share of mainstream pet foods and this makes them the third largest key account in this category after Tesco & Asda.

The situation in other countries is very different – in France only 2% of cat and 3% of dog snacks and treats are bought in non-grocery outlets (compared to 11% and 37% of the main pet food categories respectively). This may well be a function of the small category size, with non-grocery retailers therefore not stocking these products.

In Germany the shares of snack & treats bought in non grocers is higher (17% for cats & 13% for dogs), although this is again well below the shares of the main pet food categories (23% & 37% respectively). However, as discussed earlier the categories in Germany are much larger but consumers here must find both the ranges and the prices offered in mainstream retailers perfectly acceptable – in fact it is Discounters (notably Aldi) & hypermarkets that overtrade indicating that these retailers offer the prices and ranges that consumers are seeking.

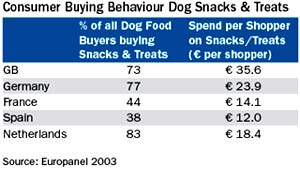

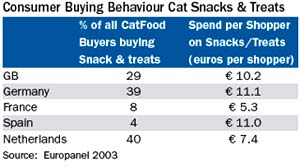

The way in which pet owning households purchase snacks and treats across all the main western European countries is very different from the way that these households buy the mainstream wet and dry pet food sectors. Because dog snacks and treats is a larger category a higher proportion of all pet foods buyers also buy this category. Hence, the opportunities for the manufacturer lie in encouraging the existing snacks and treats buyers to purchase more often and hence increase annual spend per shopper. In the cat sector, the proportion of all category buyers buying snacks & treats is much lower, resulting in a much smaller proportion of total category spend. Hence the challenge here for the manufacturer is to encourage more cat food buyers into the sector.

Further evaluation of the data reveals that there is a typical purchaser of dog snacks and treats that is consistent across all the major western European countries analysed. This purchaser is much more likely to be older and from the lower social classes. Therefore, in addition to encouraging existing consumers to buy more of the dog snacks & treats sector, there is clearly a second opportunity for the manufacturers in persuading more of the younger and up market groups to buy into this sector

As the cat snacks & treats sector is much smaller and with fewer buyers, it is far less clearly defined in terms of the profile of buyers and hence the task facing manufacturers remains as previously discussed - to recruit more buyers, and these need to be of all demographic groups in each country.

So overall, we see that treats and snacks is growing in turnover, albeit very modestly. It is a much stronger category amongst dogs than cats and also strong in Germany and Great Britain but much smaller elsewhere. Furthermore the retail trade is, perhaps surprisingly underdeveloped in the pet specialist area – with the exception of Great Britain. There is also an undertrading in all countries amongst specific demographic groups, notably younger households in the middle and upper social grade groups. Hence there are many opportunities for manufacturers and retailers alike to develop business by focussing on these areas of weakness, thereby creating a larger, more dynamic category.

Text and charts prepared by Tim Eales (IRI) and Allan Breese (Europanel), to reach via

email: tim.eales@infores.com

IRI information based upon the grocery and non-grocery scanning and retail audit tracking services covering the calendar year period of 2003 (non-grocery outlets in Great Britain and Italy are measured through an audited sample of Independent Pet Shops)

Consumer information is based on Europanel's consumer panels, which measure purchasing behaviour in each country via representative

Source: PETS International Magazine

HOME - About PetsGlobal.com - Pet Industry Links - Update my company - Contact PetsGlobal.com

© 2001-2025 PetsGlobal.com All right reserved